As Xero move towards an increasingly digital and connected world, cloud-based software solutions have become essential for businesses of all sizes. One such software that has become popular lately is Xero. Xero is a powerful accounting tool that has made managing finances a breeze for businesses. Unlike traditional accounting software, Xero can be directly connected to the business’s bank account and credit cards, reducing the time required to input financial data manually. In addition to this, Xero comes with extensive reporting features, making it easier for businesses to keep track of their income, expenses, and other essential data. Its user-friendly interface has made it a favorite in the accounting industry, making budgeting, expense tracking, and time tracking easy and fun. Plus, Xero offers unlimited users, which is perfect for businesses that need multiple users to manage their finances. Xero’s popularity is well-earned, and it is undoubtedly one of the most powerful and user-friendly accounting tools available in the market.

Xero Starter Plan

As a sole trader, starting a new business or being self-employed can be overwhelming. One of the most crucial parts of running a business is accounting, and Xero offers a fantastic solution to help manage finances. Their Starter Plan, usually priced at £15 per month, is now discounted to just £7.50 per month. That’s a savings of £45 over 6 months! This plan is ideal for sole traders, new businesses, and self-employed individuals who need a simple, affordable yet powerful accounting software. With Xero, you can keep track of all your financial transactions, expenses, invoicing, and much more with ease. So, if you’re looking for a user-friendly accounting software to streamline your business finances, be sure to check out Xero’s Starter Plan.

Included in the starter plan

Send invoices and quotes

Xero accounting software has become the go-to option for small businesses looking for an efficient and easy way to manage their finances. The Xero Starter Plan is an excellent choice for those just starting out, as it includes all the essential features to get your accounting up and running. With the starter plan, you can easily send invoices and quotes to your customers online, and even add a payment service for ultimate convenience. Although the starter plan is limited to 20 invoices, it is perfect for those new to the accounting software game who do not have hefty volumes yet. Overall, Xero Starter Plan provides an exceptional solution for small business owners looking to streamline their accounting and improve their financial management practices.

Enter bills

Keeping track of bills and ensuring timely payments can be quite a hassle for businesses. This is where Xero comes in with its efficient and user-friendly accounting software. With Xero, businesses can easily enter their bills and schedule payments, while keeping a track of the payments to be made. Not only does this streamline the payment process, but it also eliminates the stress of missed deadlines and late payment fees. Plus, Xero’s batch payment feature is a lifesaver for those with multiple bills to pay, making the entire process quick and hassle-free. For businesses with more than five bills, the standard plan offers even more features to simplify financial management.

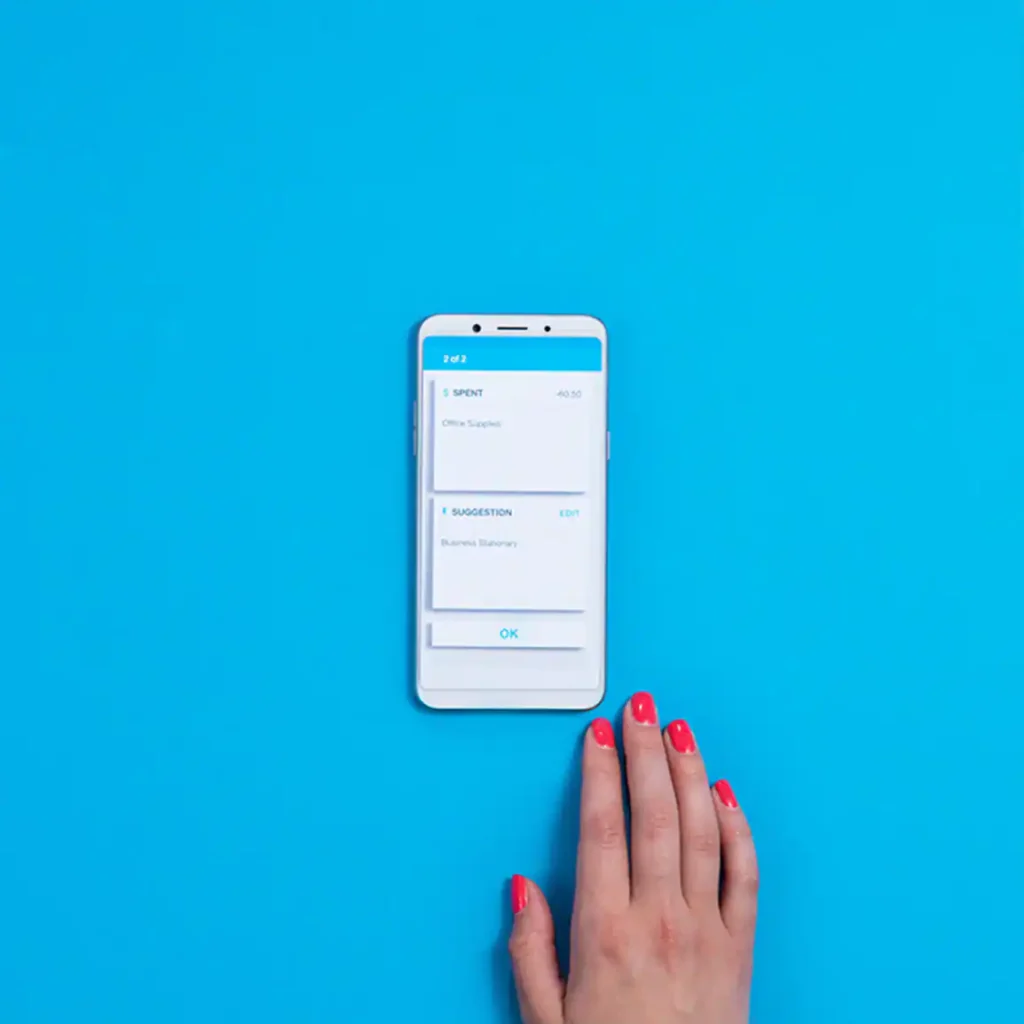

Reconcile bank transactions

Managing finances can be time-consuming, but with Xero accounting software, keeping track of your transactions becomes much easier. One particularly useful feature is the ability to reconcile bank transactions, ensuring that your bank statement accurately reflects the transactions recorded in Xero. This helps you stay on top of your finances and reduces the chances of errors. By reconciling your bank transactions, you can quickly identify any discrepancies between Xero and your bank statement, allowing you to take action if necessary. Not only does this feature save time but also potentially money – a win-win situation for any business owner.

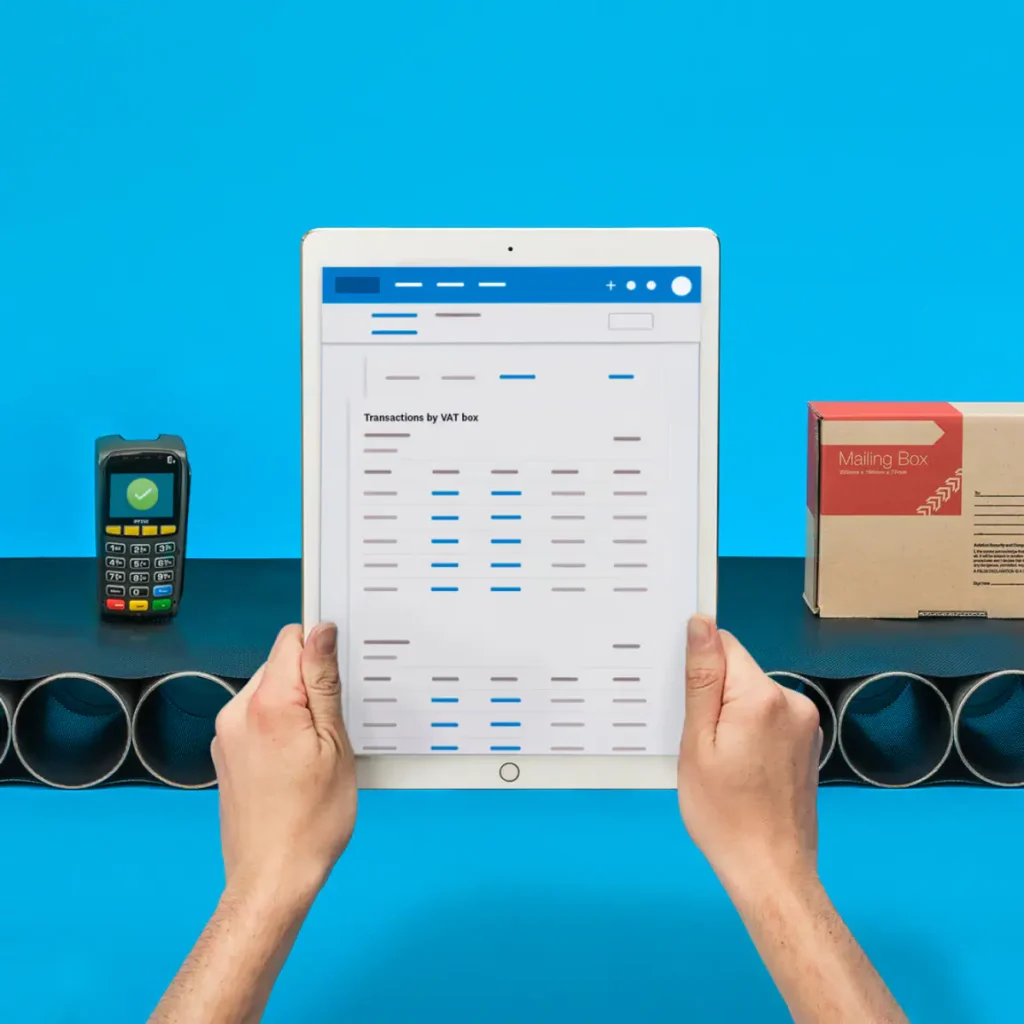

Submit VAT returns to HMRC

As a business owner, handling your VAT returns can often be stressful and time-consuming. But with Xero accounting software, you can now easily create and submit your Making Tax Digital VAT return directly to HMRC. Say goodbye to the hassle of manually filling out forms and worrying about errors, Xero makes the process smooth and effortless. With just a few clicks of a button, you can handle your VAT returns in a timely and efficient manner, giving you more time to focus on growing your business. Say hello to a stress-free VAT return process with Xero.

Capture bills and receipts with Hubdoc

As a small business owner, keeping track of bills and receipts can be a cumbersome task. However, Xero accounting software makes it easier by integrating with Hubdoc. With Hubdoc, you can capture your bills and receipts digitally, making it easier to store and manage them online. No more digging through stacks of paperwork to find a specific invoice. Everything is organized in one central location, making it easy to find what you need with just a few clicks. Plus, with automatic syncing directly with Xero, you can be sure that all of your financial records are up-to-date and accurate.

Automatic CIS calculations and reports

As a business owner, managing finances can be a daunting task, especially when it comes to calculating CIS. Fortunately, Xero accounting software has made this process much easier by integrating an automatic CIS calculation and reporting system. With just a few clicks, you can set up subcontractors, create payment and deduction statements, and view monthly return information all in one place. This not only saves you time but also ensures accuracy and compliance with legal requirements. Say goodbye to the headache of CIS calculations and hello to the convenience of Xero accounting software.

Short-term cash flow and business snapshot

As a business owner, it’s important to have a grasp on your financials. That’s where Xero accounting software comes into play. With its short-term cash flow feature, you can view a snapshot of your business’s financials up to 30 days into the future. This knowledge can give you peace of mind and help you make informed decisions. Plus, easy access to business insights means you can stay on top of your finances and make adjustments as necessary. Say goodbye to financial uncertainty and hello to a better understanding of your business with Xero.

Leave a Reply