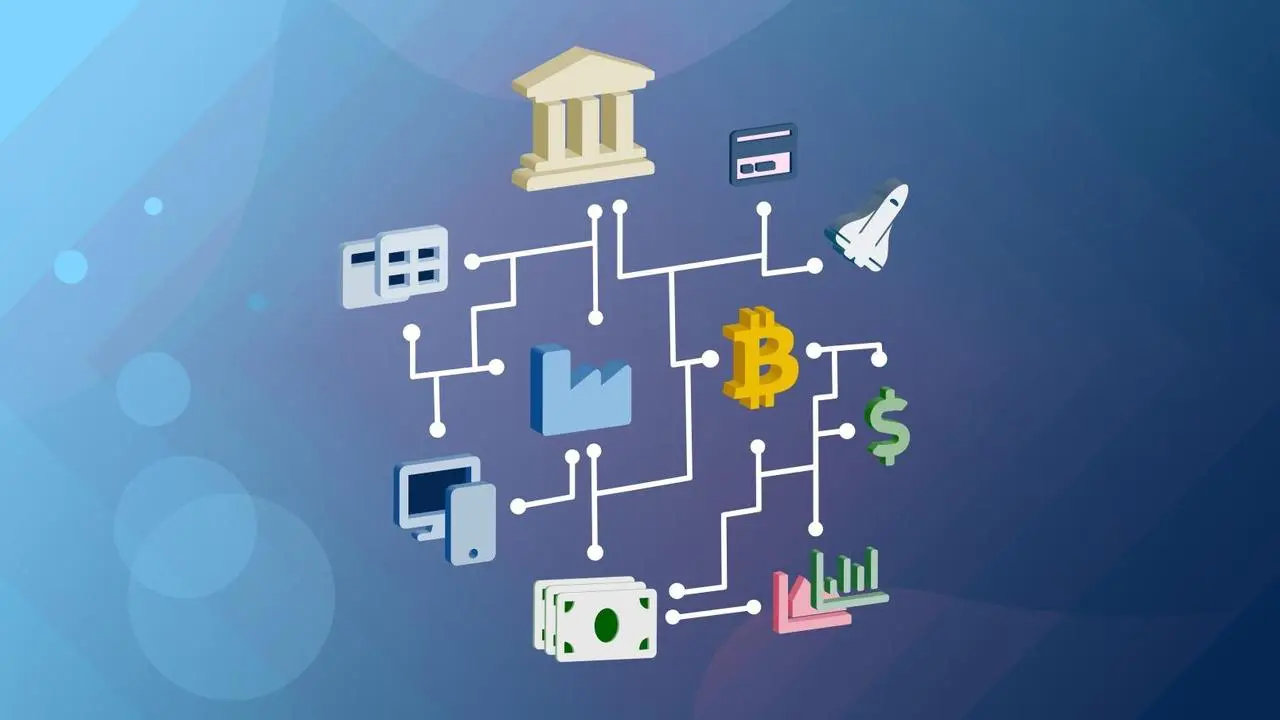

Decentralized Finance, or DeFi, has emerged as a revolutionary force reshaping the landscape of traditional banking and financial services. Built on the principles of blockchain technology, DeFi offers a new paradigm where financial transactions are conducted without intermediaries, providing greater accessibility, transparency, and efficiency to users worldwide. In this article, we delve into the intricacies of DeFi, exploring its core concepts, potential benefits, challenges, and the transformative impact it promises to bring to the world of finance.

Understanding DeFi

At its essence, DeFi refers to a decentralized ecosystem of financial applications and services that operate on blockchain networks, primarily Ethereum. These applications enable users to engage in various financial activities, including lending, borrowing, trading, and investing, without the need for traditional intermediaries like banks or brokerages. Smart contracts, self-executing contracts with the terms of the agreement directly written into code, play a pivotal role in facilitating these transactions, ensuring security, and eliminating the need for trust between parties.

Key Components of DeFi

- Decentralized Exchanges (DEXs): DEXs enable users to trade cryptocurrencies and other digital assets directly with one another, without relying on a centralized authority to facilitate transactions. Popular DEXs like Uniswap, SushiSwap, and PancakeSwap have gained significant traction, offering liquidity pools, automated market making, and yield farming opportunities.

- Lending and Borrowing Protocols: DeFi platforms allow users to lend out their digital assets and earn interest or borrow assets by collateralizing their holdings, all through smart contracts. Projects like Compound, Aave, and MakerDAO have pioneered decentralized lending and borrowing, providing users with access to liquidity and yield generation opportunities.

- Asset Management and Yield Farming: DeFi also encompasses protocols and platforms that enable users to manage their assets and optimize yields through strategies like liquidity provision, staking, and yield farming. Yield aggregators like Yearn Finance and decentralized autonomous organizations (DAOs) offer users automated strategies to maximize returns on their holdings.

- Derivatives and Synthetic Assets: DeFi is expanding into the realm of derivatives and synthetic assets, allowing users to gain exposure to traditional and exotic financial instruments in a decentralized manner. Projects like Synthetix and dYdX offer synthetic assets that track the value of real-world assets like fiat currencies, commodities, and equities.

Benefits of DeFi

- Financial Inclusion: DeFi opens up access to financial services for individuals worldwide, especially those underserved or excluded by traditional banking systems. Anyone with an internet connection can participate in DeFi, regardless of their geographic location or socioeconomic status.

- Transparency and Security: By operating on public blockchain networks, DeFi applications offer unparalleled transparency, allowing users to verify transactions and track fund flows in real-time. Additionally, the use of smart contracts ensures that transactions are executed precisely as programmed, eliminating the risk of fraud or manipulation.

- Permissionless Innovation: DeFi’s open-source nature fosters rapid innovation, as developers can build and deploy financial applications without seeking permission from centralized authorities. This enables experimentation with new ideas and business models, driving forward the evolution of the financial ecosystem.

- Elimination of Intermediaries: DeFi eliminates the need for intermediaries like banks, brokers, and clearinghouses, reducing transaction costs, and removing barriers to entry. Users have direct control over their assets, reducing counterparty risk and dependency on centralized institutions.

Challenges and Risks

- Smart Contract Risks: While smart contracts provide security and automation, they are not immune to bugs or vulnerabilities. Exploits in smart contract code can result in significant financial losses for users, highlighting the importance of rigorous auditing and testing procedures.

- Regulatory Uncertainty: DeFi operates in a rapidly evolving regulatory landscape, with regulators grappling to define its legal status and jurisdictional boundaries. Compliance with existing financial regulations, such as anti-money laundering (AML) and know-your-customer (KYC) requirements, remains a challenge for DeFi projects.

- Scalability and User Experience: As DeFi continues to gain traction, scalability issues have become apparent, leading to network congestion and high transaction fees during periods of peak activity. Improving scalability and enhancing the user experience are critical for mainstream adoption.

- Market Volatility and Liquidity Risks: DeFi markets are highly volatile and susceptible to liquidity shocks, especially in nascent or illiquid assets. Price slippage and impermanent loss pose risks to liquidity providers and investors, necessitating robust risk management strategies.

The Future of DeFi

Despite its challenges, DeFi represents a paradigm shift in the way financial services are delivered and consumed. As the ecosystem matures and innovates, we can expect to see greater integration with traditional finance, enhanced regulatory clarity, and improvements in scalability and user experience. DeFi has the potential to democratize finance, empower individuals, and unlock new avenues for economic growth and prosperity on a global scale. As we navigate this transformative journey, it is imperative to prioritize security, sustainability, and inclusivity, ensuring that the benefits of DeFi are accessible to all.

Conclusion

Decentralized Finance (DeFi) is poised to revolutionize the banking and financial services industry, offering a decentralized alternative to traditional intermediaries. By leveraging blockchain technology and smart contracts, DeFi enables greater financial inclusion, transparency, and efficiency, while also presenting challenges related to security, scalability, and regulatory compliance. As the DeFi ecosystem continues to evolve, it is crucial to foster innovation responsibly, balancing the potential benefits with the need for risk management and regulatory oversight. Ultimately, DeFi holds the promise of creating a more equitable and accessible financial system, transforming the way we interact with money and value in the digital age.

Leave a Reply